r&d tax credit calculator 2020

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. Companies for increasing their investment in RD in the current tax year.

Pay Off Credit Card Debt For Good A Complete Guide Credit Card Balance Paying Off Credit Cards Credit Card Transfer

Research and development tax credits are a UK government incentive designed to reward companies for investing in innovation.

. 114-113 made the RD tax credit permanent and added a provision permitting eligible startup companies. RD Tax Credit Calculator. Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim.

Enquire now so Lumo can fully optimise. Plus it carries forward. For Technology Ecommerce Bio-Tech Industries More.

Get Your RD Credit Estimate. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. Developing new systems processes products materials devices or any changes to the way.

Ad Pilot Takes Care Of The Entire RD Claim Process. The rate of relief is 25. The RD tax credit was created to incentivize US-based research and development activity.

Does your company tick the following boxes. Essentially a RD tax credit calculator will give you an estimate of the amount of tax credit relief that your company could receive. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Up to 12-16 cents of RD tax credit for every qualified dollar. The next step is easy. The Tax Credit Calculator is indicative only and for information purposes.

Each year more and more companies take advantage of the RD tax credit. The email address in the When you cannot use the online service section has been updated. How to calculate the RD tax credit using the traditional method.

But remember that 75000. In cashflow terms the company is worse off. What is the RD tax credit worth.

This is a dollar-for-dollar credit against taxes owed. These benefits can include the following. Save Up To 250000 For Your Business.

RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. Dollar-for-dollar reduction in your federal and state income tax liability. RRC RD Tax Credit Calculation 18000.

For most companies the credit is worth 7-10 of qualified research expenses. Is to reward US. If you spend money creating or improving products or services.

In early 2021 after youve closed. Companies to increase spending on research and development in the US. So the RD tax credit is 75000 145 10875 smaller.

The RD tax credit is a tax incentive in the form of a tax credit for US. So if your RD spend last year was 100000 you could get a 25000 reduction in your. RD Tax Credit Calculator.

It should not be used as a basis for calculations submitted in your tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad Pilot Takes Care Of The Entire RD Claim Process.

RD TAX CREDIT CALCULATOR. The purpose of the startup RD tax credit in Holtzmans words. Startups and small businesses may qualify for up to 125 million or 250000 each year for up to five years of the federal RD tax credit to offset the Federal Insurance.

RD Tax Credit Claim Experts. RD Tax Credits Calculator. First youll have to mark if your company is.

For profit-making businesses RD tax credits reduce your Corporation Tax bill. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. For Technology Ecommerce Bio-Tech Industries More.

Additionally in 2015 the. The Protecting Americans From Tax Hikes Act of 2015 PATH PL. RD Tax Credit Calculator.

RD Tax Credit Calculation. The results from our RD Tax Credit Calculator are only estimated. This result in this.

Estimate your startups RD tax credit using Kruze Consultings RD Tax Credit calculator and learn how unprofitable startups can reduce their burn rate. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. A tax credit generally reduces.

You take 50 or half of this amount which is 40000. On this page you can calculate the value of your Research Development tax credits claim. The Research and Development Expenditure Credit rate changed.

The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years. Get Your RD Credit Estimate. Save Up To 250000 For Your Business.

ASC RD Tax Credit. Call us at 208 252-5444.

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Research Development Tax Incentives

Tax Credit For Electric Cars Tax Credits Online Taxes Irs Taxes

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Stock Market Good Things

R D Tax Credit Calculation Adp

What Are Premium Tax Credits Tax Policy Center

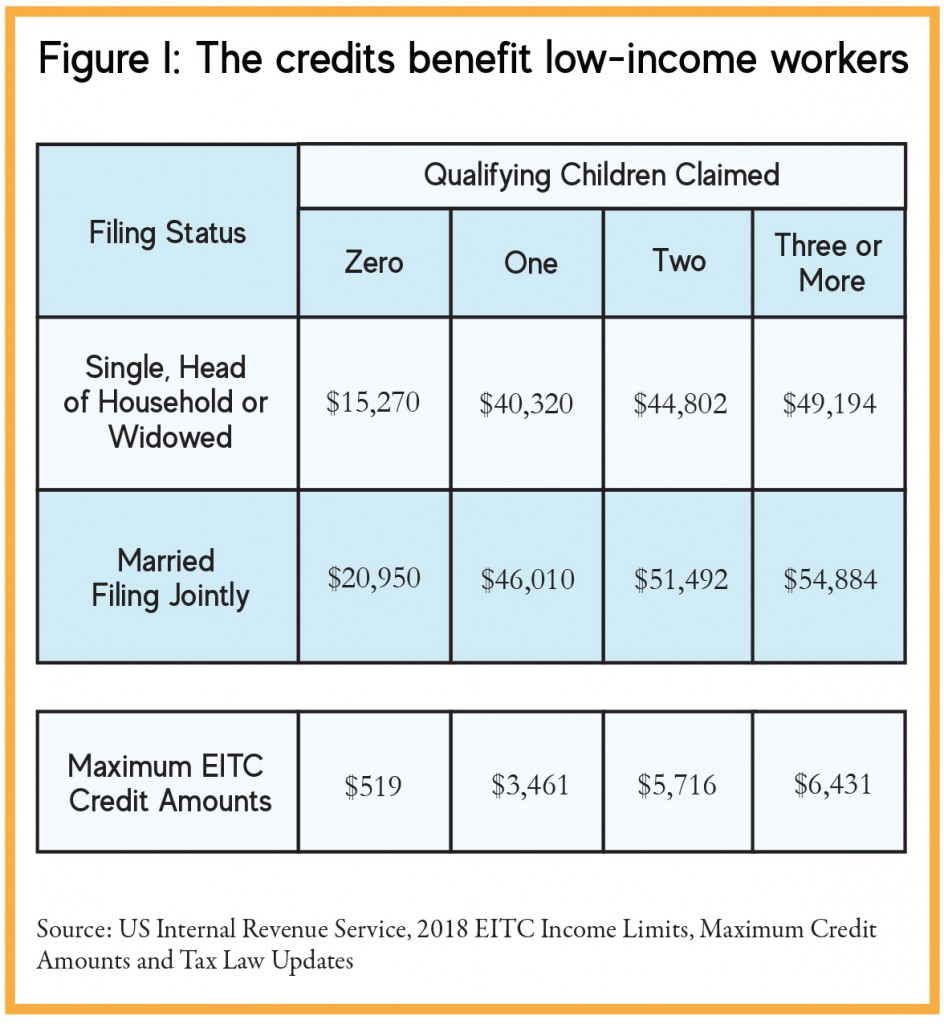

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

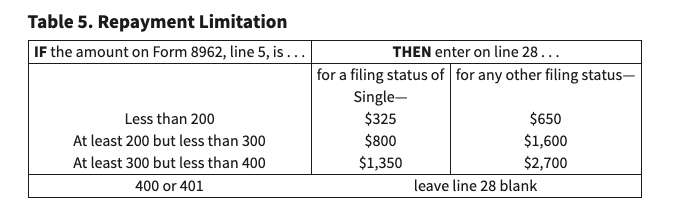

Advanced Tax Credit Repayment Limits

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

R D Tax Credit Calculation Adp

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Pin By The Solar Industry On Solar Infographics History Of Solar Energy Solar Investing

Easy Solar Tax Credit Calculator 2021

What Are Premium Tax Credits Tax Policy Center

Princeton S Annual Financial Aid Budget Grows 6 6 Percent To 147 4 Million Financial Aid Financial Aid For College Scholarships

What Is The R D Tax Credit Who Qualifies Estimate The Credit

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)